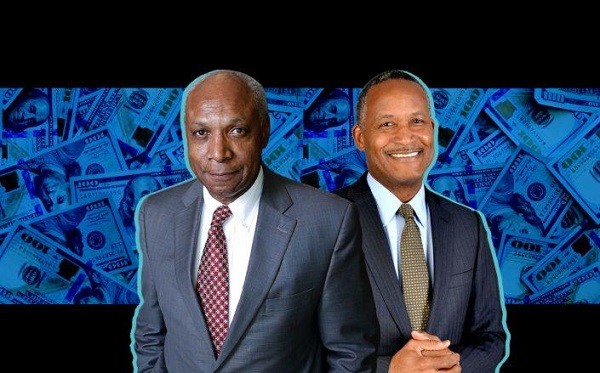

Photo credits: Getty Images and City First Bank

In an absolutely historic move in Black America’s industry of finance, two of the nation’s biggest black-owned financial firms have become the largest black U.S.-based monetary institution of all time.

According to a Wednesday (August 26) report by Shoppe Black Magazine, City First Bank of Washington D.C. and Broadway Financial Corporation of Los Angeles, California proclaimed that they have entered into a Merger of Equals Agreement. This will officially create America’s first black-owned lender with both one billion dollars in assets under management and $825 million dollars worth of depository institutional assets.

Brian A. Argrett (pictured right), the CEO of City First, will become the CEO of the new company, which has resulted from the merger. In the new deal, City First will continue to brand itself as a traditional banker with the Broadway Financial Corporation acting as its holdings company. Wayne-Kent A. Bradshaw (pictured left) the CEO of Broadway Financial will be the chairman of the new company formed from the merger.

Throughout their upstanding history, City First Bank and Broadway Financial Corporation have primarily operated as monetary gatekeepers for community development. They have championed the advocacy of low to moderate-income neighborhoods by improving their socioeconomic equity. The new company formed in this merger will allocate 60 percent of its lending toward these very same predominately-black communities.

From early 2015 until now, City First Bank and the Broadway Financial Institution have shelled out over a billion dollars worth of investments and loans for the benefit of the low to moderate-income communities they have collectively prioritized.

“Given the compounding factors of a global pandemic, unprecedented unemployment and social unrest resulting from centuries of inequities, the work of CDFIs has never been more urgent and necessary,” Argrett said in a statement, according to Shoppe Black.

As part of this historic merger, we are demonstrating that thriving urban neighborhoods are viable markets that require a dedicated focus, long-term commitment and critical access to capital,” he continued.

A statement from Broadway Financial Corporation’s CEO echoed the enthusiasm expressed by City Bank’s leadership.

“The new combined institution will strengthen our position and will help drive both sustainable economic growth and societal returns,” Bradshaw said in a statement, according to Shoppe Black.

“We envision building stronger profitability and creating a multiplier effect of capital availability for our customers and for the communities we serve.” he added.

The new firm will continue to be headquartered on the East and West coasts of the U.S. Investment potential will also be utilized in other parts of the country where the institutions have not yet reached. News of the merger increased the price of shares at Broadway Financial by 17 percent. When the new deal goes into effect, City First’s shareholders will own 47.5 percent of the new company.

Broadway Financial’s stockholders will own 52.5 percent of the new company when the deal closes. The finalization of this historic merger will become official in early 2021.

“

No comments